The cabinet of Indian government has recently launched a new pension scheme with the name of Unified Pension Scheme. After a long debate on NPS vs OPS, finally central government employees have received a middle ground for their demands related to pension scheme.

What is UPS – Unified Pension Scheme?

This is the new pension scheme which will provide assurance to the central government employees a retirement pension. The provisions of this scheme are:

- Central government employees who have completed 10 years of service will be entitled to receive pension benefits starting from minimum of Rs 10000.

- Employees completing the service for 25 years will receive 50% of their income one year ago as pension.

- If service is less than 25 years, the pension will be given on pro-rata basis.

- Family Pension is ensured at 60% of the income in case of casualties during service.

- Employees will have an option to choose between NPS and UPS.

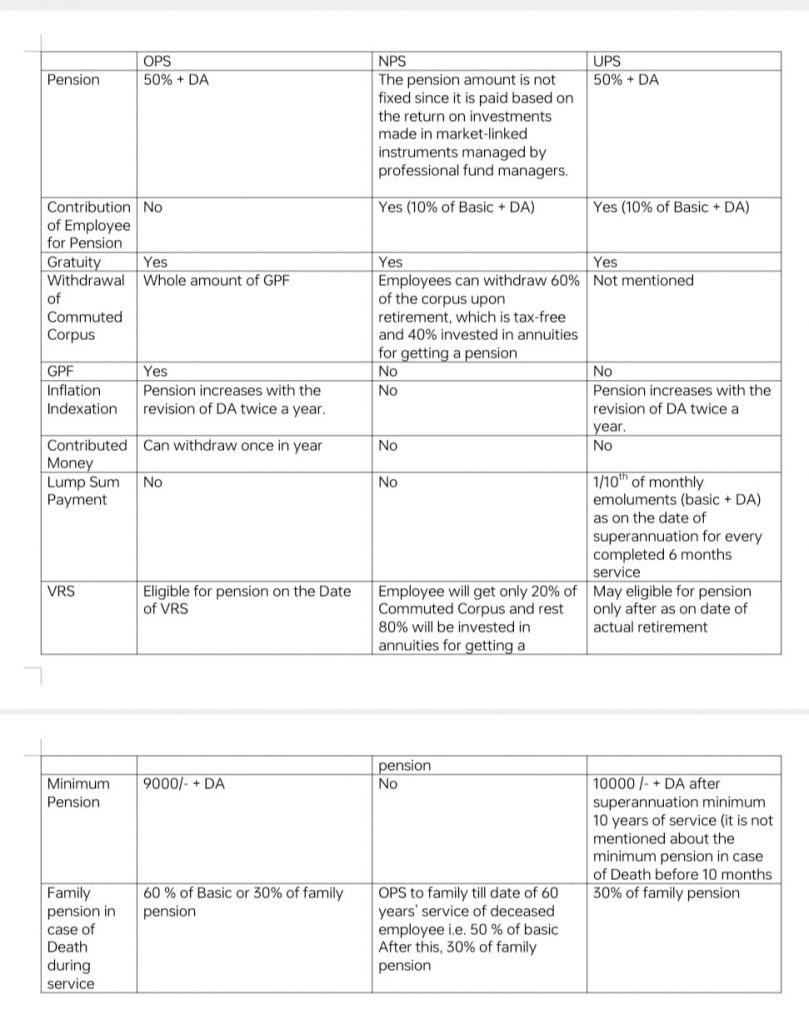

How is UPS different from NPS (New Pension Scheme)?

In the existing pension scheme i.e. New Pension Scheme, the amount of pension benefits are totally dependent on the market conditions at the time of retirement. However, the scheme was unsatisfactory with most of the government employees considering the volatility of the market. That’s why, there has been a constant demand to reimplement Old Pension Scheme (OPS) for the employees.

How is UPS different from OPS (Old Pension Scheme)?

Old Pension Scheme provides the benefits for providing fixed pension to employees and their families after retirement. The major difference is the employee contribution in UPS which was not there in OPS and no provision of withdrawal in UPS. Also, GPF provision was there in the OPS which is not there in UPS.

Few users have compiled a detailed comparison of UPS vs OPS vs NPS as: